How End-to-End Supply Chain Design Enables Nearshoring and Reshoring

September 2, 2025 | By Jabil Procurement & Supply Chain Team

For decades, the global supply chain playbook prioritized low-cost production in distant markets, often at the expense of speed and control. But that model is showing its age.

A series of disruptions, from COVID-19 shutdowns to tariff wars, port congestion, and geopolitical volatility, have exposed the hidden costs of extended, brittle networks. As a result, companies are reconsidering where and how they produce goods. What’s emerging is a decisive move away from global sprawl toward more regional, responsive, and resilient models.

Nearshoring and Reshoring: More Than Just a Trend

This shift goes by many names, nearshoring, reshoring, regionalization, but the trend is unmistakable: businesses are bringing production closer to their end markets to reduce risk, improve agility, and regain control. Companies are projected to invest $650 billion in reshoring initiatives over the next three years, a clear signal that this is more than a passing reaction, it’s a structural realignment of supply chain strategy.

Yet simply changing locations isn’t enough. To make nearshoring or reshoring work, companies must rethink the entire architecture of their supply chain, from supplier relationships and transportation networks to inventory management, technology systems, and procurement.

That’s where end-to-end supply chain design comes in. It’s not just about moving factories; it’s about designing an interconnected system that can thrive in a world of constant change.

The Spectrum of Localization Strategies

As global supply chains grow more complex and risk-prone, companies are rethinking their production footprints with a more strategic lens. Localization is no longer viewed as a binary decision, but as part of a broader continuum of supply chain design, one that aligns geographic reach with operational resilience and customer proximity.

Rather than fully abandoning global networks, many organizations are rebalancing them. This evolution spans a spectrum of strategies:

Each step along this continuum reflects a different approach to managing cost, control, responsiveness, and risk. The goal isn’t simply to relocate operations, it’s to build smarter, more adaptive supply networks that are positioned to perform under pressure.

Understanding Localization for Supply Chain Design

Each point on the localization spectrum offers distinct advantages and requires tailored supply chain design to succeed. Here's how leading companies are applying each strategy:

-

Globalization: Leveraging globally dispersed supplier networks and production centers to maximize efficiency and scale. While this model drove cost savings for decades, it often introduces extended lead times, lower visibility, and higher exposure to geopolitical risk.

Example: An electronics company sourcing components from Asia, assembling in Eastern Europe, and distributing to global markets through centralized hubs. -

Regionalization: Creating self-sufficient supply hubs within major consumer markets (e.g., North America, Europe, Asia). This model reduces exposure to cross-border disruptions and increases responsiveness.

Example: A medical manufacturer operating parallel production lines in the U.S., Europe, and Asia to serve regional demand efficiently. -

Nearshoring: Relocating production or sourcing to nearby countries with cost and logistical advantages. This approach improves flexibility and shortens transit times while retaining access to lower-cost labor.

Example: A U.S. automaker shifting manufacturing from Asia to Mexico to shorten lead times and improve transport reliability. -

Reshoring: Bringing production fully back to the company’s home country to enhance control, IP security, and regulatory alignment. Reshoring is often chosen for high-value products, sensitive industries, or national security concerns.

Example: A consumer electronics firm building final assembly plants in the U.S. for faster turnaround and “Made in America” branding.

How Organizations Are Localizing Supply Chains

Most companies aren’t making a clean break from globalization, they’re evolving toward more dynamic, blended models. Rather than choosing a single strategy, supply chain leaders are increasingly mixing localization tactics to match customer needs, cost structures, and risk profiles.

In practice, this often looks like:

- Nearshoring for component production in nearby, lower-cost countries

- Regionalization for customer support and distribution within major markets

- Reshoring for high-value, sensitive, or regulated product lines

This layered approach reflects a fundamental shift: supply chains are becoming more adaptive ecosystems, not static networks. In this model, the supply chain becomes a portfolio of geographically aligned capabilities, each designed to improve speed, reduce risk, and maximize resilience. Solutions like Jabil’s Supply Chain Managed Services help companies orchestrate these complex, blended models by aligning strategy, execution, and visibility across regions.

Some experts suggest that nearshoring is reshaping globalization, not reversing it. It’s not just about where production takes place, but how effectively the supply chain flexes around customer proximity, compliance requirements, logistics infrastructure, and supplier strength.

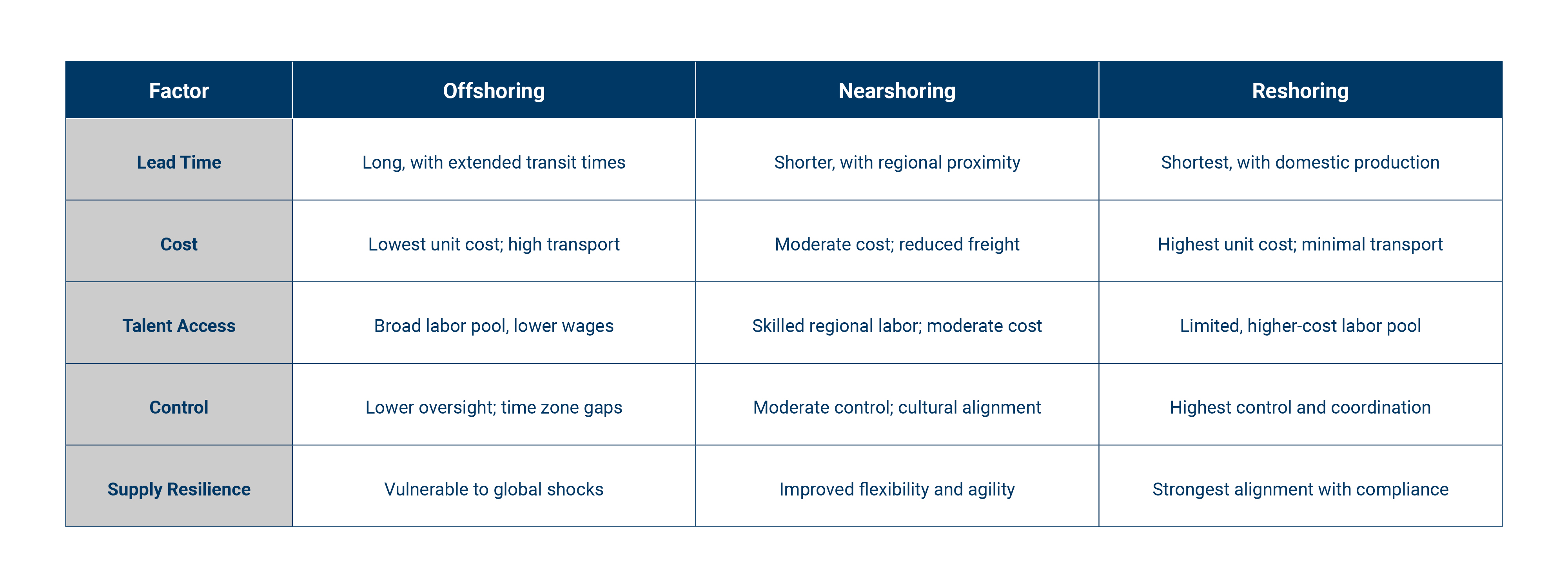

Weighing the Trade-Offs: Nearshoring, Reshoring, and Offshoring Compared

Shifting production closer to end markets offers significant advantages, but no strategy is without trade-offs. Nearshoring and reshoring may reduce lead times and increase control, but they often require greater upfront investment, changes in supplier relationships, and a long-term view of value creation.

For supply chain leaders evaluating their options, the right strategy depends on priorities, cost, flexibility, speed, resilience, or control. A growing number of firms are taking action: in a recent global survey, over half of midmarket companies in North America reported pursuing nearshoring strategies, while 66% said they were increasing U.S.-based manufacturing.

Comparative Snapshot: Supply Chain Strategy Trade-Offs

How Companies Are Localizing with Purpose

Many companies are actively localizing supply chains through a mix of sourcing shifts and operational redesign. As global uncertainty continues to pressure cost structures and delivery timelines, more organizations are reevaluating where and how their supply chains operate.

Recent data shows:

- 78% are seeking U.S.-based suppliers

- 44% are moving operations out of China

- 22% are redesigning products to eliminate foreign parts

For example, UK firms are expanding in Buenos Aires and Tijuana to reduce disruption risk, while a broader shift toward domestic supplier development is expected to accelerate in the next 12–18 months. These efforts reflect a growing recognition that localization isn’t just about geography, it’s about creating flexible, resilient systems that align sourcing, design, and delivery.

Designing End-to-End Supply Chain for Localization

Relocating production is only one piece of the localization puzzle. For nearshoring and reshoring strategies to succeed, companies must redesign their entire supply chain, from sourcing and inventory to transportation and technology, to function as a connected, regionally responsive system.

The Transportation Resilience Index (TRI) measures how well a region can maintain logistics continuity during disruptions. While 84% of a region’s TRI score depends on external conditions like infrastructure quality and trade policy, research shows that company-level design choices, like modal flexibility, supplier mix, and inventory strategies, can still meaningfully influence outcomes.

That means even in the face of macro-level risk, organizations can improve resilience through intentional, end-to-end design that aligns with their localization goals. With Jabil’s Supply Chain Consulting Services, companies can strategically reconfigure supplier networks, optimize transportation infrastructure, and enhance digital visibility, turning complex supply chains into agile, regionally responsive systems.

To build this kind of resilience and responsiveness, companies may want to focus on several core elements when designing supply chains for localization.

Key Elements of Localized Supply Chain Design

- Supplier Network Segmentation: Companies are moving away from “one-size-fits-all” sourcing. Instead, they’re using segmentation strategies to assign suppliers based on product complexity, margin contribution, or market volatility. High-value or regulated products may warrant reshoring; commodity parts may remain offshore or nearshore.

- Transportation Redesign: Nearshoring only improves speed and cost if freight modes and distribution hubs are reengineered to support it. Leaders are updating Incoterms, embracing intermodal strategies, and investing in regional distribution centers to match new production footprints.

-

Technology Integration: Digital infrastructure is no longer optional. From Microsoft Fabric to AI-powered analytics and digital twins, companies are building smart systems that offer visibility, scenario modeling, and rapid response. These tools enable localized supply chains to function as dynamic, data-driven networks.

Together, these elements transform supply chains from static cost centers into strategic assets, capable of flexing around regional demand, managing global risk, and supporting long-term growth.

Decision Guide: When to Regionalize, Nearshore, or Reshore

Localization is rarely a binary choice. For many businesses, the question isn’t if they should localize, but how, where, and to what extent. The right strategy will depend on a range of factors, from operating costs and customer proximity to regulatory needs and supply chain complexity.

Rather than offering a one-size-fits-all approach, this guide outlines key considerations that may help companies determine which localization strategy, or combination, could best support their goals.

When Regionalization May Be a Fit

Regionalization can be effective when companies are looking to establish self-sufficient supply capabilities within major consumer regions like North America, Europe, or Asia. This strategy may be worth exploring for organizations that:

- Serve markets with unique logistical or compliance requirements

- Operate across diverse geographies and want to diversify supply risk

- Need to support multiple product categories with local adaptations

- Prioritize proximity without full replication of global operations

This model allows for responsiveness across regions while maintaining some economies of scale.

When Nearshoring Could Offer Advantages

Nearshoring may appeal to companies aiming to reduce lead times, improve transport reliability, or hedge against geopolitical uncertainty, without fully bringing production onshore. It might be suitable for:

- Sourcing or producing components in neighboring countries

- Markets where labor cost and time-to-market need to be balanced

- Businesses expanding within adjacent or regional customer bases

- Supply chains vulnerable to long-distance disruption

To be successful, nearshoring often requires reevaluating freight strategies, supplier networks, and last-mile distribution plans.

When Reshoring Might Be Appropriate

Reshoring could provide the highest level of control and compliance for certain organizations. It may be appropriate when:

- Products are high-value, IP-sensitive, or heavily regulated

- There’s a strategic focus on domestic manufacturing or branding

- Automation and skilled labor are accessible locally

- Incentives or policy frameworks favor domestic investment

While reshoring can offer strong benefits, companies may want to carefully weigh switching costs and long-term return on investment.

Why Supply Chain Design Is Key to a Localized Future

Nearshoring and reshoring are not just logistical decisions, they are strategic commitments that require integrated design across sourcing, transportation, technology, and supplier networks.

As global uncertainty persists and customer expectations rise, organizations that invest in end-to-end supply chain design will be best positioned to localize with purpose, not just proximity.

Whether you're exploring regional hubs, diversifying suppliers, or optimizing transport networks, the journey toward localization begins with a more connected, intelligent, and resilient supply chain.

Interested in building a more resilient supply chain?

Learn how Jabil’s Procurement and Supply Chain Services can support your localization goals with the tools, expertise, and global reach to turn strategy into action.